Tencent to invest in more non-game companies

Chinese tech giant looking to diversify its investment portfolio

Tencent Holdings plans to increase investment overseas and outside of the video games market.

While the Chinese tech giant’s globalisation strategy has been led by investments in and partnerships with video game companies, it plans to diversify its portfolio in order to support its WeChat messaging, social media and mobile payment app.

“Previously our traditional investment sectors were mostly focused on video games content and frontiers of science and technology,” Tencent president Martin Lau said at a recent conference (via Reuters).

“However, with the development of Tencent’s WeChat mini-app ecosystem and payment platform, we will pay more attention to smart retail and payment platforms in future.”

Tencent has already invested in more than 800 companies and is worth $490 billion, making it Asia’s second-biggest company by market value after Alibaba Group Holdings, according to the report.

As well as owning League of Legends maker Riot Games, it has a 40% stake in Epic Games and holds shares in Activision Blizzard, Ubisoft and PUBG Corporation parent company Bluehole, among others.

In November 2019 it acquired a 10% stake in Sumo Group, the parent company of Team Sonic Racing studio Sumo Digital, while Bayonetta developer PlatinumGames said this month it has received investment from Tencent which will see it remain independent while allowing it to explore self-publishing.

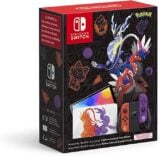

Nintendo launched its flagship Switch console in China in December with the help of local partner Tencent, and the Chinese Nintendo eShop supports the WeChat payment service.

Tencent has reportedly said it wants to develop console games using Nintendo characters in a bid to grow its business in the US and Europe.